Property assessments for some Powell River homeowners are way up, but that does not mean homeowners’ property tax bills will see a corresponding increase in property taxes.

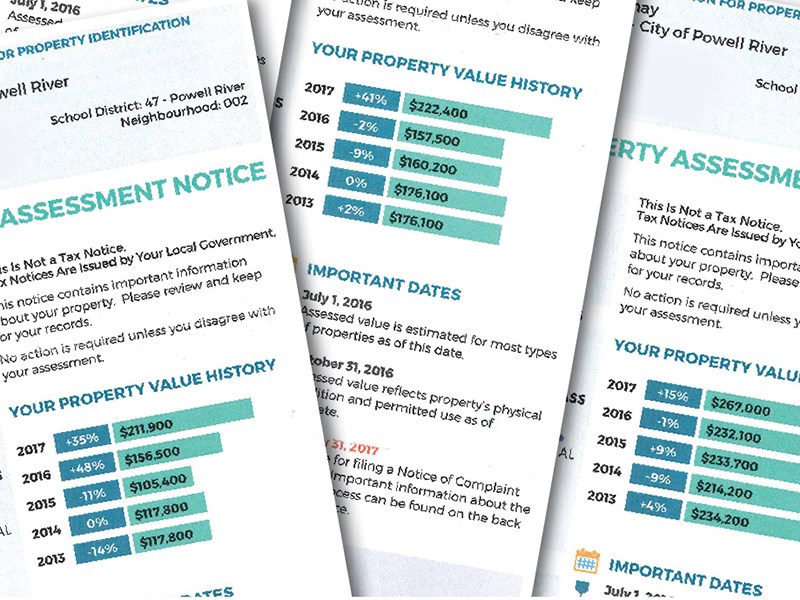

Crown corporation BC Assessment announced Tuesday, January 3, that assessments were in the mail and Powell River area residents could expect to see increases of between 5.4 for rural residents and 10.4 per cent for City of Powell River residents, but some local homeowners opened their mail to find much higher increases.

“The majority of residential home assessments within the [Vancouver Island] region are shifting between five to 25 per cent compared to last year’s assessments,” stated BC Assessment regional assessor Tina Ireland in a media release.

The total assessments in Vancouver Island region, which includes Powell River, increased from $170.15 billion last year to $193.21 billion this year, or 13.5 per cent.

According to the Crown corporation, a strong real estate market over the past year is behind some of the large increases. Other factors, such as home renovations, can also increase assessed values. The 2017 assessments reflect market value as of July 1 and physical condition of properties as of October 31.

Similar to Lower Mainland and southern Vancouver Island homeowners, who opened their assessments to find hikes as high as 60 per cent, local residents are also raising questions about what the assessment increases will mean.

City of Powell River councillor Russell Brewer took to social media to explain what role the assessments play in property owners’ municipal taxes.

“I posted on social media to meet an obvious need for more information on the part of the public regarding assessments, impact on taxes and how taxes are determined,” said Brewer. “I view that as a critical part of my role as a councillor.”

City taxes are based primarily on two factors: the city’s revenue requirement to fund services and infrastructure throughout the year and the city’s assessment base, or the total assessed value of all properties in the city.

Municipal tax rates are set by dividing the city’s revenue requirement by its assessment base. The resulting tax rate is then applied to each individual property based on its assessed value and zoning to determine what the property owner’s taxes payable will be.

BC municipalities are legally obliged to operate using balanced operating budgets, though they are allowed to borrow for capital projects.

In 2016, property taxes brought in $15.5 million for City of Powell River. More than half of the city’s revenue comes from property taxes, the rest from government grants and other fees, said city chief financial officer Kathleen Day.

Determining how much a property owner pays for tax requires first seeing what all the revenues and costs will be and then looking at how much money is required to make up the difference.

Day explained that council then needs to decide if it is willing to increase taxes to bring in the required funds or whether it will look to cut funds from somewhere else.

“It’s a bit of a process,” said Day.

Changes in assessments determine how the overall municipal property tax requirement is distributed to each property owner. Homeowners who have large increases in their assessments can expect to pay more taxes than those with smaller increases.

Anyone with a higher-than-average assessment can expect to pay a larger part of the city’s revenue requirement, said Day. Only properties that go up by the average assessment increase will experience the average tax increase that council decides when it passes the city budget, she added.

“If the average tax increase is 11 per cent, a property owner with a 20 per cent increase in their assessed value will experience a higher-than-average tax increase,” said Day. “A property owner with a five per cent increase in their assessed value will experience a lower-than-average tax increase.”

The assessment system is an attempt to minimize the impact of real estate market fluctuations on property taxes, but it can only work with the average, said Day.

The city also collects annual municipal utility charges and taxes on behalf of the regional district and School District 47.

The city is currently in the process of establishing its 2017 operating budgets and determining what its revenue requirements will be. Tax rates will be set once the budget is established. A draft city budget is expected later this month.

According to Brewer, council focused on minimizing tax increases, particularly for operations, for the past three years. Because the consumer price index has continued to rise during that time, an increase in property taxes is probable, said Brewer.

“Some increases for operations will likely be required for 2017,” he said.

Property tax increases are finalized in early May with the adoption of the city’s financial plan and tax rates bylaws; tax notices are mailed later that month.

More information about municipal tax rates in 2017 will be available as council works through its budget and financial planning process, which includes opportunities for public input. The finance committee’s first meeting of 2017 is set for Thursday, January 12, at city hall.

Day said property owners with questions about assessment notices should refer to the BC Assessments website and contact the agency as indicated on their notice as soon as possible. Home owners who wish to appeal their assessments have until January 31 to file.