by Laura Walz [email protected] Catalyst Paper Corporation deferred a $21-million interest payment that was due December 15 as it continues talks with bondholders to reduce its debt level. Catalyst has 30 days to make the interest payment before triggering default on its corporate debt.

Operations of Catalyst and its subsidiaries are expected to continue as usual with obligations to customers, suppliers and employees being met, the company said in a statement.

“We advised several months ago that we were actively pursuing a restructuring of our balance sheet,” said Kevin Clarke, president and CEO. “This is a very complex process and while we cannot prejudge outcomes, we are firmly committed to achieving a solution that puts Catalyst on stronger financial footing for the future.”

Catalyst’s total debt was listed at $840 million in its third-quarter financial results. The company began the review of its capital structure in June 2011 and has been negotiating with 2014 and 2016 bondholders to deal with the existing debt structure. If it fails to make the interest payment within 30 days, the 2016 bondholders could declare the $390-million principal amount and all accrued interest immediately.

Kevin Mason, of Equity Research Associates, said this has been expected for a long time. “Just the timing of the eventual restructuring has always been a bit of an open question, but this basically signals that it’s come to that point where they’re looking at doing something,” he said.

Essentially the equity is wiped out and the bondholders effectively recapitalize the company, Mason added. “Their operations still generate cash flow, but the struggle is they’ve got far too much debt than those operations can support. They have to effectively wipe the slate clean, restructure the company and be able to move forward from there.”

The bondholders will effectively take control of the company, Mason said. “The battle is now over what is the true value,” he said. “In the restructuring process, that’s what you have to come up with. Amongst all the bondholders, there will be a lot of toing and froing in figuring out what is the true value of this enterprise, or what people think it is. That will help determine how things proceed going forward.”

Operations are not at risk, Mason said, “unless there is an asset that is bleeding the money right now, then you’d have some risk of something shutting down. But if there is cash being generated and the future looks reasonable, the bondholders want to keep everything operating that is contributing anything to the enterprise.”

The recycled newsprint plant at Snowflake, Arizona is more the concern within the Catalyst structure, Mason said. “That mill has been talked about as being a bit of a drain out there, so if anything’s at risk, that one is probably near the top of the list.”

In an update to its members, the Communications, Energy and Paperworkers’ Union reported Catalyst and representatives from local unions and legal counsels were in discussions. The company assured local unions in a meeting on December 14 that the mills will continue to operate during the deferral period in a manner that will see them meet the delivery of the product to their customers. “This action will not impact our members’ day-to-day lives,” the report noted.

Local unions continue to meet to discuss the options that are available to them up to and including entering into early negotiations for a renewal of the 2008-2012 collective agreement. “Entering into these discussions is made with the undertaking that any agreement would be contingent upon an agreement being reached with the bondholders to reduce Catalyst’s debt and a standard agreement being reached throughout the three mills,” the report stated.

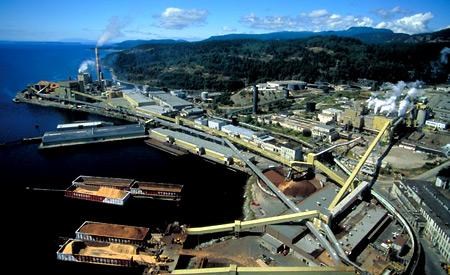

In Powell River, Catalyst employs about 400 people and, at the end of 2010, paid $46 million in salaries, wages and benefits, $3 million in property taxes and $3.8 million in spending with local vendors.

On the Toronto Stock Exchange, Catalyst shares were trading at two cents on Tuesday, December 20.