Taxpayer Kathryn Hjorleifson has requested that City of Powell River Council hold the 2022 tax increase to zero per cent.

At the January 18 committee of the whole meeting, Hjorleifson appeared before councillors to appeal for an adjustment in the mill rate to hold city taxes at the current level.

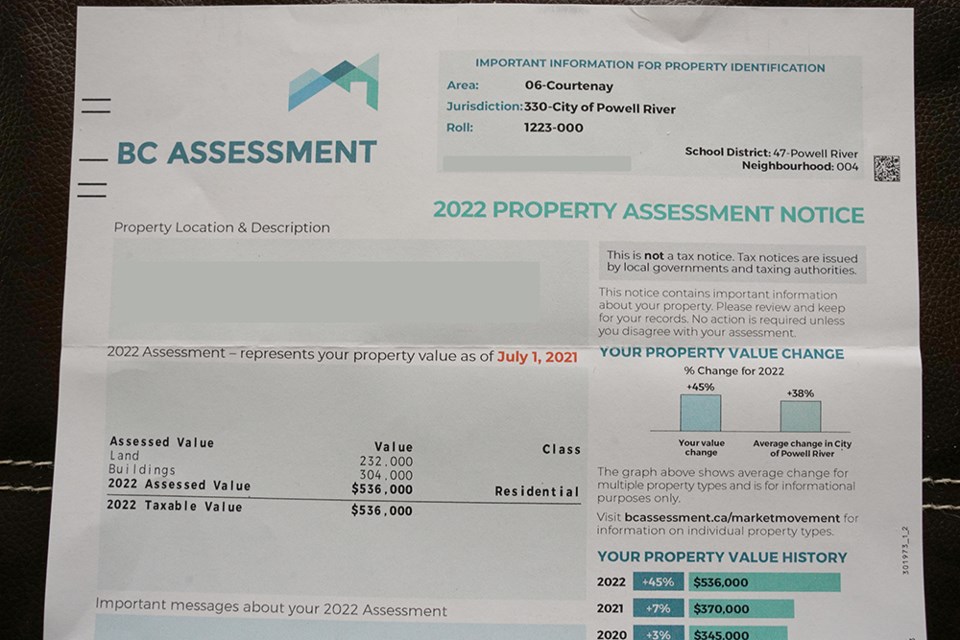

“We all pay different taxes, but it’s my property taxes that have been in my thoughts since the arrival of my BC property assessment,” said Hjorleifson. “I guess it’s nice that my property value has gone up 46 per cent, but, since I’m not planning to sell or downsize, this assessment has only increased my financial anxiety.”

Hjorleifson said she called the BC Assessment helpline to confirm her property taxes are mill rate times assessed value.

She said she did some further investigations while experiencing her financial anxiety. If the current mill rate is applied to her assessment, her taxes would go up about 34 per cent, she indicated.

“After settling down, I realized that this won’t happen,” said Hjorleifson. “Cool heads, calculating heads will adjust the rate. So, I thought ‘what mill rate should I think about?’ I came to a very clear conviction. That is that our property taxes should not go up at all.

“It’s safe to say, with inflation, most especially on basics, such as food, utilities and fuel, that members in this community are already dealing with less real income per household. With COVID-19, many residents have faced a decrease in income in the past two years. So, property taxes must not be raised.”

Hjorleifson said to accomplish this, she calls for a maximum mill rate of 5.744. She said doing so wouldn’t mean the city’s budget would be less because there has been new housing constructed.

“I call for a 5.744 mill rate, or less, for 2022,” added Hjorleifson.

Mayor fields calls

Mayor Dave Formosa said his phone is ringing off the hook regarding assessments and taxes. He said chief financial officer Adam Langenmaier can perhaps outline the mill rate that he is using for tax calculations.

Formosa added that there are some taxes over which the city has no control. He said there will be a 16 per cent increase from qathet Regional District this year for city residents, and the city does not control the hospital and school district rates.

“We collect all the money, so many people think they are our taxes and they get very angry with us,” said Formosa.

Formosa said Hjorleifson is advocating no increase in taxes, but the city has to fund the new consolidated wastewater treatment plant, inflation, the new solid-waste transfer station that is being built, et cetera.

Langenmaier said the completed roll has been received from BC Assessment. He said the new average value for a home in the city is $535,000, up from last year’s figure of $383,000.

He said regarding comments on the mill rate, the mill rate last year was 5.32. For 2022, the city is looking for a significant drop in the mill rate because assessments have risen, according to Langenmaier.

Hjorleifson said to address the mayor’s comments, the city has additional costs, but every community faces these costs.

“Other communities have to deal with water treatment, hospitals and education, and they don’t have control of these costs,” said Hjorleifson. “It’s not something that just our community has to deal with. It seems to me that all communities have to deal with this.

“The big message for me is holding property taxes and considering ways to reduce them, and having some long-term conversations about where we’ve been and where we should be going.”

Taxes depend on expenses, says councillor

Councillor George Doubt said the important response is because the property assessment increased, it does not follow that the tax burden will increase by the same amount.

“I hear your message that you want a zero per cent tax rate,” said Doubt. “The answer to many of the other questions you have will become more apparent next week at our finance committee meeting, where we are having another look at the five-year financial plan; we’re looking at the expenses for the city. The directors of the city will be coming back with a response to previous requests from council to keep taxes as low as possible. All of that detail will be discussed at the finance committee.”

Doubt said the first step is to determine what the city’s costs and expenses will be, and then working at that to a tax requisition, and distributing that among the various properties in the city according to the assessments. He said taxes depend on the expenses the city determines to spend, starting at the finance committee meeting, rather than the assessed value of properties.

“We’ll be looking at the city’s expenses and trying to find a way to keep those as low as possible while still providing the services people want,” said Doubt.

Councillor and committee of the whole chair Maggie Hathaway said she encourages everyone to attend or watch on webcast the finance committee meeting on January 27 at 1:30 pm.

“You can see what we go through, because it is an interesting process and it’s a difficult process, and none of us at this table take it lightly,” said Hathaway. “We work through the numbers the very best that we can.”

Councillor Cindy Elliott said she would love to have a budget with a zero per cent tax increase, but to do so, the city would have to lay off workers.

“We’ll definitely keep in mind people’s struggles over the last year,” added Elliott, “and the financial position we are all in.”