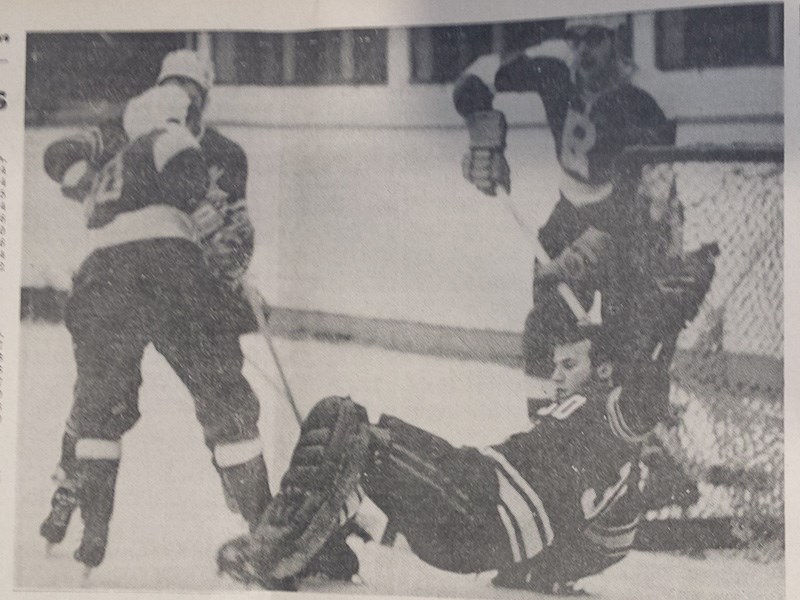

The photo above and article below were published in the Powell River News on January 8, 1970.

Small business owners express resentment at municipal increase in business tax from 6 to 8 per cent

Reaction of local business owners to recent increase in municipal business tax has varied from: “The municipality is just doing its part to contribute towards national inflation,” to “It doesn’t really mean much to me, only another $3 to $4 a year.”

But there was a general complaint that every level of government, from the federal white paper on taxation to the municipal tax increase that “they’re all out to get the small businessman.”

Last year small business owners paid five per cent tax on the assessed annual rental value of business premises. This year that has been upped to eight per cent. The increase brings small businesses in line with the percentage rental tax paid by MacMillan Bloedel. 1969 amendment to the municipal act made this equalization mandatory.

“The amendment was passed at the last session of the 1969 legislature in Victoria,” T. McVea, municipal assessor, told The News.

L. Pagani, proprietor of Vets Shoe Repairs on Marine, said the increase barely affected him.

“The increase is only $3 or $4 a year,” he said.

J. Cripps of One Hour Martinizing found his business harder hit. Taxes went up from $106.80 in ’69 to $157 in ’70. In addition the dry cleaner must pay $328 machinery tax.

“Seems like we are being taxed to death,” said Cripps.

Another small business owner with about six employees, who wished to remain anonymous, said he used to operate on a 50 per cent markup.

“With these added taxes it seems like I will have to increase this markup.”

He added that the increase in municipal taxes was just one of many.

“Seems like bad public relations as far as I’m concerned. On the one hand, Trudeau says, ‘Hold the line;’ then council ups business tax and Dr. Shrum adds 15 per cent to hydro costs, all contributing towards national inflation. Getting tougher every year to stay in business,” he said wryly.

To larger firms like Burg and Johnson, who operate a lumber yard and a concrete mixing plant with 25 employees, the tax increase means a $200 hike which, according to a spokesman, is barely felt. Licence fee is deductible from the increase.

Small food stores, like Tom Fairweather’s, showed resentment at the increase.

Said Fairweather, “It’s just the old story, ‘The rich get richer and the poor get poorer’” He said his taxes had “just about doubled.”

Fairweather indicated other “iniquities” facing the small store owners.

“I pay an average of three cents a kilowatt hour for hydro, whereas the domestic owner pays two and a half cents for the first 600 kwh,” he said. “Larger stores are able to use their own transformer and pay a low flat rate.”

Owner of Westview Sea Foods Les Jacques expressed similar sentiments.

“Where is it going to stop?” asked Jacques. “My business tax went up $14 and my home taxes went up another $103.”

Jacques was critical of the way water bills for his business are assessed.

“Cost of water for my plant went up 100 per cent last year. I was told this was because of the heavy volume I use; yet I use only 25 per cent of the water here at the plant I do at home,” he said.

Jacques also complained of the recent increase in hydro rates and that he was charged four and a half cents per kilowatt hour for hydro while a domestic user only pays two and a half cents. “I bought a canning licence this year and it cost me $400, the same as BC Packers pay. Seems that it’s the little people, the small business man who always suffers.”

Gordon Turner made no bones about how he felt.

“Municipal tax increase! Do you want to come down here and take a photo of the hole in the roof, or the claw marks on the wall?” he said. “Costs are continually going up,” he said, “and the businessman has to transfer that cost to the customer. Taxes go up before business goes up.”

Turner, who installs local cablevision, said it was also unfair that the municipality taxed him on a percentage of gross rentals rather than on a net figure. His business tax has gone up from $130 to $194.40.

“We pay this municipality another $4,000 for the privilege of doing business here,’ he said “All council seems to do is hike taxes and this always seems to reflect on the small business man.”

Business tax expected by the municipality this year totals $382,159. Various sources estimate that MacMillan Bloedel pay well in excess of half that tax.