The tax was killed with 54.73 per cent of voters turning it down, while 41.76 per cent wanted to keep it. In Powell River-Sunshine Coast, 58.24 per cent of residents voted to scrap the tax and 41.76 per cent wanted to keep it. There was a total of 20,942 ballots cast in the riding, with 12,197 against the tax and 8,745 for it.

Nicholas Simons, New Democratic Party (NDP) MLA for Powell River-Sunshine Coast, said this was an historic day. “It’s the first time a petition has triggered a referendum and this referendum has quite clearly said to government that people reject their public policy direction and their method of introducing it,” he said. “I think it’s a clear statement that people don’t want the HST and they would have preferred that the government keep its promise.”

He expects the government to step away from “the threats and the fear tactics that they were using during the campaign and come up with this so-called Plan B that [Premier] Christy Clark says she has up her sleeve,” Simons also said. “By now she should be higher in the alphabet.”

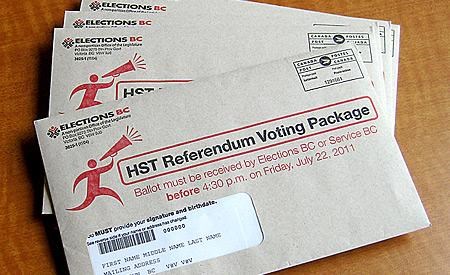

In February 2010, British Columbia's Chief Electoral Office approved a petition submitted by William Vander Zalm, a former BC premier, to rescind the HST and restore the PST. More than 500,000 people signed the petition, triggering a vote. Registered BC voters were able to cast their mail-in ballots from June 13 to August 5. More than 1.6 million people sent their HST referendum ballots back to Elections BC. That is about 52 per cent of all BC's eligible voters.

If the no votes had won, BC would have kept the HST. The tax would have then been reduced to 11 per cent in 2012 and 10 per cent in 2014.

Clark had offered offered families with children and low and modest-income seniors one-time transition cheques of $175 per child and senior.

In a statement on the BC Liberal website, Clark said, “While I am disappointed by the results, the public has spoken and now we turn the page.

“Let me be clear about one thing—we will return to the PST with the exemptions that existed prior to the introduction of the HST. That is what people voted for and that is what will happen.”

In planning to return to the GST/PST system, the province will also be introducing measures “that keep us competitive and help BC businesses create jobs and maintain the jobs we have in BC,” Clark also said.

“The HST debate has been a long, sometimes contentious, process for our province. While I shared your concern at the way the HST was brought in, our government tired to make things right by listening and engaging with you, then making bold changes.

“This is a change in how government works and we are going to stick with this open government approach.”

BC New Democratic Party leader Adrian Dix said the result of the referendum was a victory for fairness and democracy. “The people won over the arrogance of the Liberal government and its powerful friends,” he said in a statement.

“For a decade, the Liberal Party has shifted the tax burden onto BC families. A return to the PST will be good for communities, good for families and good for small business. It will make life a little bit more affordable for working families. It will also ensure that British Columbia has control over its sales tax policy, now and in the future.”

Kevin Falcon, BC’s minister of finance, said the province will reinstate the combined 12 per cent PST and GST tax system. The transition period is expected to take a minimum of 18 months, to March 31, 2013, and during this time the provincial portion of the HST will remain in place at seven per cent.

“British Columbians have made their choice and we will honour that decision,” Falcon said in a statement. “Now more than ever, government must provide British Columbians economic stability and focus our attention toward growing our economy to create jobs and balancing our budget in a time of global economic uncertainty.”

The statement indicated the PST will be reinstated at seven per cent with all permanent PST exemptions. “The province may make some common sense administrative improvements to streamline the PST,” the release stated.

“I can assure British Columbians PST will not be applied to such items as restaurant meals, haircuts, bikes and gym memberships—just as it was before the HST was introduced in BC.”

The province will begin discussions next month with the federal government about repaying $1.68 billion in federal funding it received for implementing the HST.