Catalyst Paper Corporation will continue to work on changing the rules surrounding municipal taxation of major industries, according to Kevin Clarke, president and CEO.

The Supreme Court of Canada dismissed Catalyst’s appeal of its property taxes in North Cowichan. In an unanimous decision released on Friday, January 20, the high court judges reinforced the broad power of municipalities to vary rates between different classes of property. As well, municipal councils are entitled to consider broader social, economic and political issues, not merely objective considerations, when passing bylaws. Catalyst had argued the North Cowichan tax rates were too high because they bore no relationship to the municipal services the company actually used.

“That is surely not the result that we wanted,” Clarke told the Peak in a phone interview. “For me, it’s not a logical conclusion, but it surely just starts us up a different path.”

The Supreme Court decision noted that BC’s Community Charter gives municipalities a “broad and virtually unfettered legislative discretion to establish property tax rates in respect of each of the property classes in the municipality, unless limited by regulation.”

It pointed out that in 1985, the provincial government “ceased to impose regulatory limits on the ratios between tax rates.”

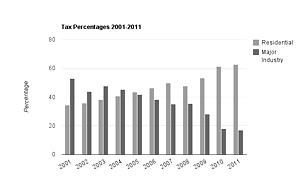

A section of the Community Charter allows the government to regulate the relationships between Class 1 and Class 4 tax rates, the decision noted, and “no regulation of this sort has been reintroduced since the repeal of the 1984 regulation, which prescribed a 1-to-3.4 ratio between residential and major industry tax rates.”

Clarke said Catalyst will pursue having BC’s legislation changed. “We have always stated we want to pay every nickel of tax we owe, but not a nickel more, so we’ll start up the legislative path,” he said. “In some towns we provide 30-plus per cent of the town’s tax base. If people think that’s appropriate, they might be killing the golden goose.”

Catalyst went to court in 2009, fighting what it called unsustainable and unfair property tax rates in BC towns and cities where it operates. It lost lawsuits against Powell River, Campbell River, Port Alberni and North Cowichan.

Catalyst decided to appeal the judgment handed down about North Cowichan. A BC Court of Appeal dismissed its case in April 2010 and the company decided to petition Canada’s highest court.

“We’ll continue along this path and we’ll try to find an innovative solution with our partners in the communities,” said Clarke. “In Powell River, we have a very cooperative relationship surrounding the tax issue and in some of our other municipalities, we don’t.”

City of Powell River council adopted a tax revitalization bylaw that set 2011 major industry taxes at $2.25 million. In 2011, it passed a tax revitalization bylaw with the same tax formula for four years, 2012 to 2015.

The bylaw, permitted under the Community Charter, was one of the provisions contained in an agreement in principle (AIP) between the city and Catalyst, signed in April 2010.

Clarke said he has reached out to the new mayor of North Cowichan, Jon Lefebure, and said “let’s sit down and figure out how we form a better relationship that’s good for both of us.”

Clarke said he told Lefebure that Catalyst has great support with Dave Formosa, Powell River’s mayor. Clarke said he told Lefebure Formosa was “a business guy, he’s an intelligent guy, he’s a guy that looks at options. I will do the same with the new mayor in Port Alberni. We want to be supporters and cooperative partners with our municipalities, because many of our employees live there and we are in the centre of some of those towns. We want to make sure we’re a good corporate citizen, but we don’t want to pay disproportionally for it.”