City of Powell River Council has given first three readings to a revitalization tax exemption program of three years for Catalyst Paper Corporation.

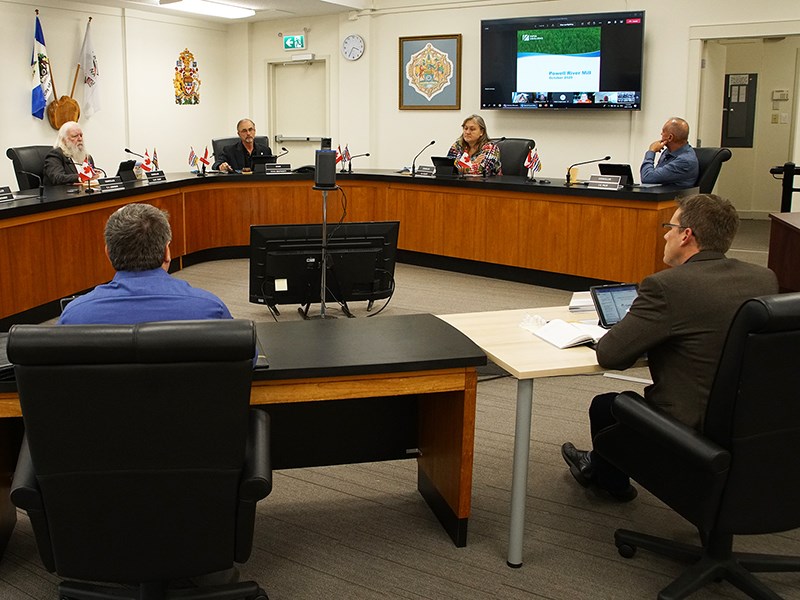

At a special council meeting on October 8, councillors voted unanimously in favour of the motion, which would cap the major industry tax assessment at a maximum taxable value of $3.2 million. This would raise the revitalization tax exemption program by $150,000 a year over the previous bylaw, which was set at $3,050,000.

In introducing the tax exemption bylaw, chief financial officer Adam Langenmaier said the current bylaw expires at the end of 2020. He said the city had been approached by Catalyst to have another revitalization bylaw.

Langenmaier said if there was no revitalization bylaw, mill taxes would return to levels assessed prior to introduction of successive revitalization tax exemption bylaws. He outlined that in the year 2000, the industrial property paid $5,676,124 in municipal property taxes. In the year 2010, the industrial property paid $2,244,106 and for the past three years, paid $3,050,000.

“The proposal before council today is to continue with a fixed property tax rate for the next three years at $3.2 million,” said Langenmaier. “This represents about a five per cent increase over the prior years.

“I am proposing this to council because Catalyst has met all of the requirements for the tax revitalization program. They have paid their taxes by the deadline and they have no outstanding property taxes. This is a useful tool to give stability to mill operations. It gives better certainty on tax collection.”

Langenmaier said if council gave the first three readings of the bylaw, public notification would be required, with details outlined in the newspaper for two weeks. The bylaw would then come back to council for final approval.

Councillor Cindy Elliott said she had some concerns around the rate being set for the bylaw. She said she liked the fact that it would be going up five per cent in the first year but that did not take into account the rate of inflation in the subsequent years.

“I wouldn’t mind setting it for the three years so it’s contributing an appropriate similar percentage each year,” said Elliott. “If costs are rising at a two per cent rate, for example, there should be a two per cent increase the following year so we are not eroding away our tax base by staying at the same level. That’s what I would prefer to see.”’

Councillor George Doubt said he was in favour of the proposed bylaw the way it reads. He said one of the things about the revitalization tax exemption program is it provides an incentive to the taxpayer who is taking advantage of the program to pay their taxes regularly, and that’s one of the advantages of this program.

“Renewing the tax revitalization bylaw will do that and extend that for the next three years,” said Doubt. “It will support the mill, an important employer that employs a large number of people in the community and will hopefully go on and successfully employ many people for many years to come. We’ve heard from the corporation that cost is a major factor and they need a break like this to continue.”

Doubt said overall, this increases taxes the city will collect by $150,000 for this year, which is a significant shift away from the burden homeowners face, to the industrial sector.

“I’m in favour of it,” said Doubt. “It supports the mill and it supports our community and it provides a greater amount of taxes into the coffers of the city.”

Mayor Dave Formosa said he was in support of the motion as it is.

He said the increase of $150,000 is just a little more than a one per cent increase in the city’s overall tax collection.

Formosa said as background, when the city first endorsed a revitalization tax exemption bylaw, the amount collected was $1.75 million and over time that figure has risen, to the $3.2 million being proposed under this latest bylaw.

“We have been increasing as we go along, and every time we do, they ask us to leave it as it is, but we can’t,” said Formosa. “We do take advantage of increasing it when we can.”

Councillor Maggie Hathaway said she agreed with the motion, as did councillor Rob Southcott, who chaired the special council meeting.

Prior to considering the revitalization tax exemption program, council heard from Patrick Corriveau, vice-president of paper and packaging with Catalyst, who outlined the company’s position and difficulties it faces in these uncertain financial times.